The Markets in Crypto-Assets (MiCA) regulation is finally in full effect; the third stage of this much-awaited crypto regulatory framework for the EU region came into place on December 30th, 2024.

At the same time, financial service companies – including crypto firms – in the EU are now required to be fully compliant with the Digital Operational Resilience Act (DORA) which introduces strict cybersecurity provisions to safeguard against ICT-related incidents.

With MiCA and DORA applicable across the EU, crypto compliance teams are turning to solutions that will help them become compliant with the regulation’s provisions. Data-driven platforms for identifying and evaluating smart contract related risks such as the one offered by Trugard are emerging as a much-needed tool in navigating this new regulatory territory.

For context, the MiCA regulation focuses on several critical areas which include stablecoin regulation (asset-referenced tokens and e-money tokens), licensing of Crypto-Asset Service Providers (CASPs), consumer protection, market integrity, prevention of market abuse and insider trading.

Most of the crypto companies operating in countries within the EU are not fully ready to comply with all the provisions outlined under the different sections of the MiCA regulation. In some jurisdictions like Poland and Czechia, less than 5% of registered crypto businesses are ready to become MiCA-compliant.

While the figures vary in other jurisdictions such as Estonia where most VASPs are ready for MiCA compliance, there is still a huge technical support gap that needs to be addressed for more companies to transition into the MiCA and DORA regulatory frameworks. This explains why crypto teams in the EU have recently been turning to compliance solutions.

Source Code Detection: Trugard’s Edge in MiCA & DORA Compliance

One of the most important provisions of these new regulatory frameworks is consumer protection; while digital assets have indeed changed the outlook of modern-day finance, the ecosystem is not short of malicious players who are constantly trying to attack smart contract infrastructures or directly targeting crypto users’ non-custodial wallets.

Trugard’s Xcalibur source code analyzer, alongside other crypto compliance capabilities, are specifically designed to identify such threats.

“The MiCA and DORA frameworks impose stringent compliance and cybersecurity requirements on the crypto industry, presenting opportunities for companies like Trugard Labs to drive innovation and support businesses in adapting. Leveraging expertise in blockchain security and advanced analytics, Trugard delivers compliance automation tools, risk management systems, and scalable cybersecurity solutions.” – Jeremiah O’Connor, CTO and Co-Founder at Trugard.

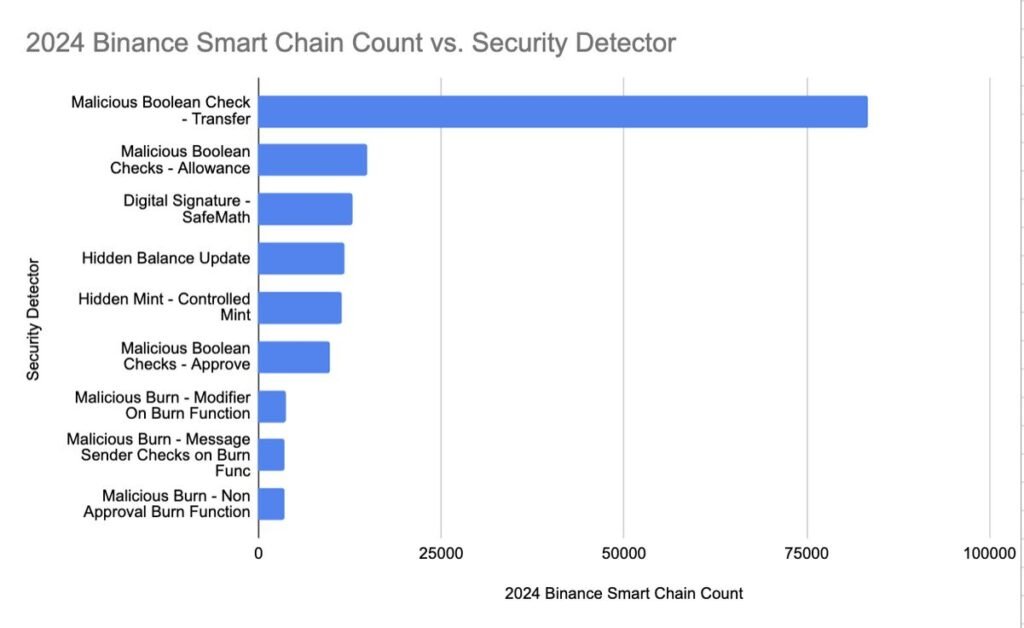

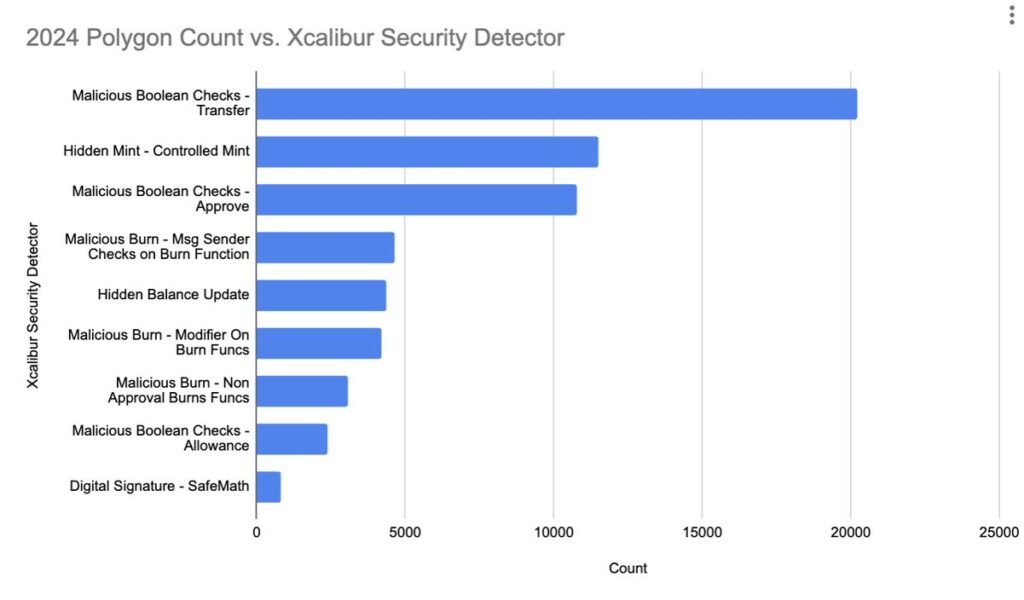

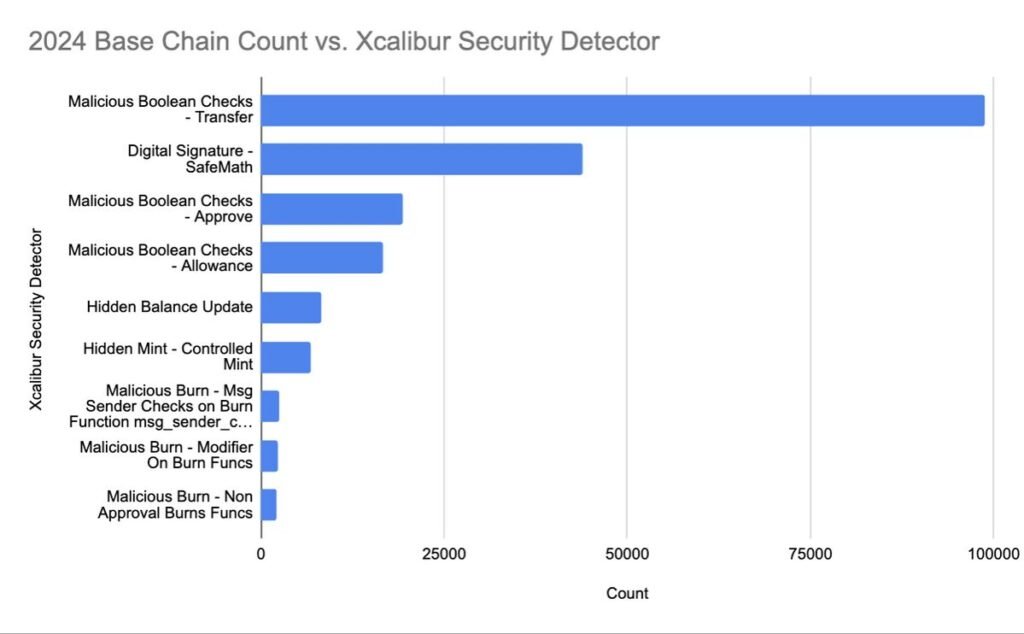

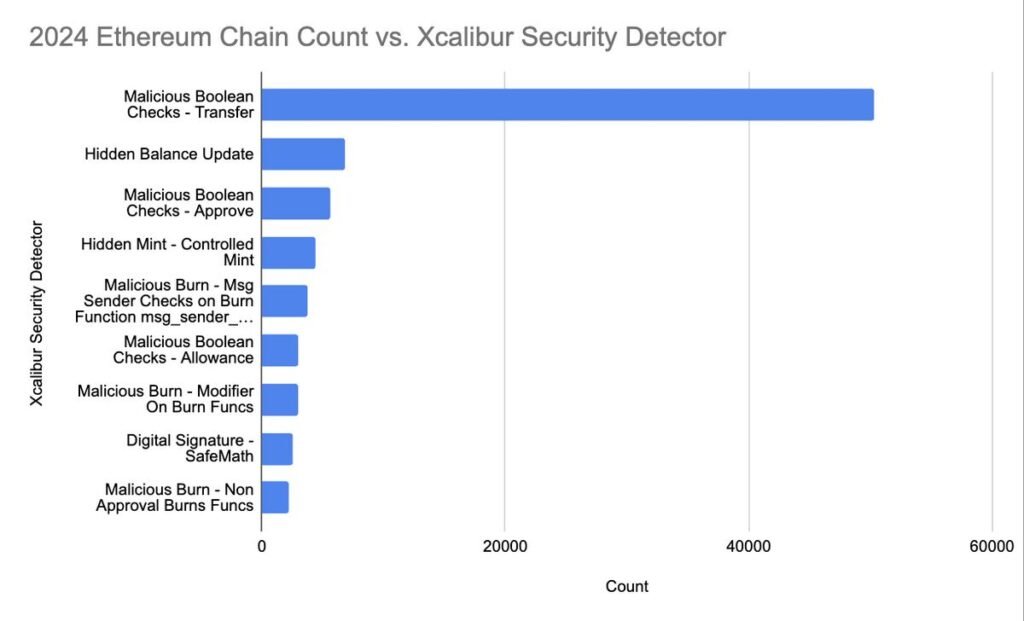

In 2024, the Xcalibur tool detected five major threats across top chains, including Binance Smart Chain, Base Chain, Polygon, and Ethereum. Some of the high-risk threats that were identified include; Hidden Mint – Controlled Mint (Severity: High), Hidden Balance Update (Severity: High), Malicious Boolean Checks (Severity: High), Malicious Burn (Severity: High) and Digital Signature/Import Tampering (Severity: High).

Going by this analysis, it is evident that ‘Malicious Boolean Checks – Transfer’ were the most prevalent form of threat across all the featured blockchains, with Base recording the highest number at 98,739. The proactive identification of such threats by CASPs and VASPs is important for the companies to be able to better protect their users while at the same time complying with MiCA’s provision on consumer protection.

Trugard’s Xcalibur tool operates through a GraphQL-powered API, making it seamless for compliance teams to use the existing API documentation to run security risk analysis across several blockchains. This ease of use is important in enhancing the safety of crypto users in the EU given that compliance teams get better access to risk insights that are critical in the proactive elimination of potential threats.

In addition to Xcalibur, Trugard features other detection capabilities which include bytecode analysis where a collection of detectors and machine learning models are used to identify threats within a specific bytecode. The data-driven platform also offers reverse engineering or decompilation capabilities, spanning across 4-byte signatures and Opcode detection.

Conclusion

MiCA and DORA frameworks will certainly change the EU’s crypto landscape moving forward. Crypto companies operating in this region have no option but to operate within the provisions set by the two regulatory frameworks.

It may seem like a lot of work, especially for the companies that are not ready; however, with compliance solutions such as Trugard already in place, it will be much easier for companies to be compliant with MiCA’s stringent requirements, including continuous automated vulnerability scanning and transaction monitoring.