(BRUSSELS) – Europe’s VAT rules are to be made simpler, more fraud-proof and business-friendly as a result of the European Commission’s plans to reboot the current EU VAT system, unveiled Friday.

The current VAT rules urgently need to be updated, says the Commission, supporting trade across EU borders, and helping to keep pace with Europe’s increasingly digital and mobile economy.

The ‘VAT gap’ – the difference between the expected VAT revenue and VAT actually collected in the EU Member States, was almost EUR 170 billion in 2013. Cross-border fraud itself is estimated to be responsible for a VAT revenue loss of around EUR 50 billion a year in the European Union. At the same time, the current VAT system is responsible for creating “significant administrative burdens”, according to the Commission, especially for smaller companies (SMEs) and companies operating online.

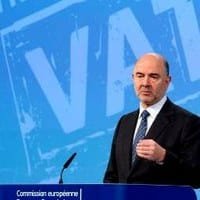

The Action Plan, announced today by Economic and Financial Affairs Commissioner Pierre Moscovici in Brussels, sets out a pathway to modernise the current EU VAT rules, including:

- key principles for a future single European VAT system;

- short term measures to tackle VAT fraud;

- update the framework for VAT rates and set out options to grant Member States greater flexibility in setting them;

- plans to simplify VAT rules for e-commerce in the context of the Digital Single Market (DSM) Strategy and for a comprehensive VAT package to make life easier for SMEs.

Mr Moscovici highlighted the “EU’s staggering fiscal gap”, saying VAT revenues collected are some EUR 170 billion short of what they should be. “This is a huge waste of money that could be invested on growth and jobs,” he added. He was also keen that the EU should grant Member States more autonomy on how to define their VAT reduced rates

Key elements of the plan

A future definitive EU VAT system for cross-border trade to reduce opportunities for fraud

The current VAT system needs to be modernised to keep pace with the challenges of today’s global, digital and mobile economy. The current VAT system for cross-border trade which came into force in 1993 was intended to be a transitional system and leaves the door open to fraud. The Commission therefore intends to come forward in 2017 with a proposal to put in place definitive rules for a single European VAT area. Under the new rules, cross-border transactions would continue to be taxed at the rates of the Member State of destination (‘destination principle’) as today, but the way taxes are collected would be gradually changed towards a more fraud-proof system. At the same time, an EU-wide web portal would be implemented to ensure a simple VAT collection system for businesses and a more robust system for Member States to gather revenue.

Immediate measures to tackle VAT fraud under the current rules

Cross-border VAT fraud deprives Member States of vast sums of revenue. Estimates show that the future VAT system could reduce cross-border fraud by around EUR 40 billion (or by 80%) a year. Later this year, the Commission will propose measures to reinforce current tools used by Member States to exchange information related to VAT fraud, fraud schemes and good practices. We will continue to closely monitor the performance of tax administrations in collecting and controlling VAT.

More autonomy for Member States to choose their own rates policy

Under the current rules, Member States need to stick to a pre-defined list of goods and services when it comes to applying zero or reduced VAT rates. The Commission plans to modernise the framework for rates and to give Member States more flexibility in future. It proposes two options: one option would be to maintain the minimum standard rate of 15% and to review regularly the list of goods and services which can benefit from reduced rates, based on Member States’ input. The second option would abolish the list of goods and services that can benefit from reduced rates. This would, however, require safeguards to prevent fraud, avoid unfair tax competition within the Single Market and it could also increase compliance costs for businesses. Under both options, the currently applicable zero and reduced rates would be maintained.

Support for e-commerce and SMEs

The current VAT system for cross-border e-commerce is complex and costly for Member States and businesses alike. EU businesses are at a competitive disadvantage because certain non-EU traders can import VAT-free goods to the EU. The complexity of the system also makes it difficult for Member States to ensure compliance. The Commission will come forward by the end of 2016 with a legislative proposal to modernise and simplify VAT for cross-border e-commerce as part of the Digital Single Market strategy. This will include a proposal to ensure that e-publications can benefit from the same reduced rates as physical publications. As a second step, we will present in 2017 a VAT simplification package designed to support the growth of SMEs and to make it easier for them to trade across borders.

Background facts

The common Value Added Tax (VAT) system raises almost EUR 1 trillion in 2014, corresponding to 7% of EU GDP. One of the EU’s own resources is also based on VAT.

The current VAT system was intended to be a transitional system. Its fragmentation makes it difficult for the businesses operating cross-border, and it leaves the door open to fraud: domestic and cross-border transactions are treated differently and goods or services can be bought free of VAT within the Single Market.

Next Steps

The Commission will ask the European Parliament and the Council, supported by the European Economic and Social Committee, to provide clear political guidance on the options put forward in this Action Plan and to confirm their support for the reforms set out in this Communication.

The Commission will present proposals on all issues in 2016 and 2017.

Further information:

Information on the Action Plan on VAT

Commission Memo on the Action Plan on VAT